Sunscreen Monograph Proposed New Rules and its Impact on Formulations-Part III

Introduction

Ever Since the FDA published its proposed rules in February of 2019 reclassifying 14 of the 16 sunscreens approved as Category I to Category II and III, the entire US sunscreen market has been upside down. Most sunscreen manufacturers scrambled to formulate new products incorporating mineral sunscreens like Zinc Oxide and Titanium Dioxide since they were the only sunscreens left as Category I.

Mineral Sunscreens

Although most companies have mineral formulations already, these are mostly targeted to babies and young children. Now the pressure is on to produce mineral sunscreens with high SPF suitable for all consumers and that can compete with organic formulations. This is a task that is not easily achieved, especially with the whitening effect associated with these formulations. Raw material suppliers have been also affected. Polymers, SPF boosters, emulsifiers, and other key ingredients that provided a benefit in organic sunscreen formulations are no longer promoted. Instead, most raw material manufacturers have to promote ingredients that work mainly in mineral formulations.

Market Snapshot for Zinc-Based Formulations

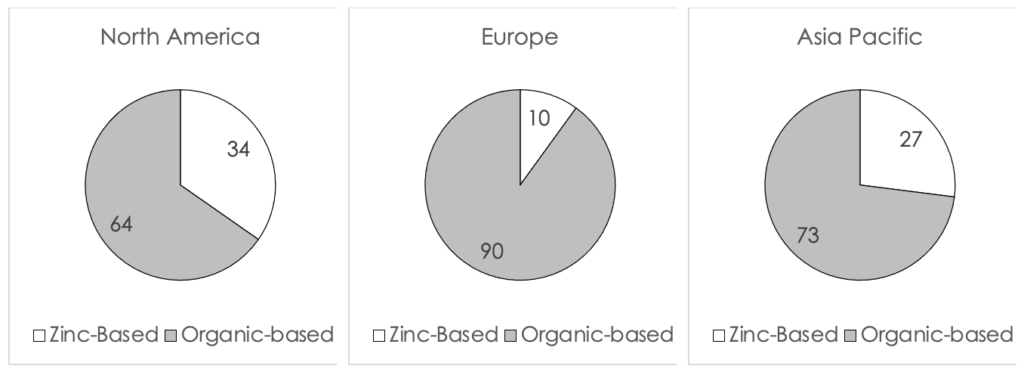

A snapshot of the percent of zinc-based formulations launched globally from 2018 to 2020 (to date) is displayed in Figure I (below). The data shows that the US (34%) leads both Europe (10%) and Asia Pacific (27%) in the percent of new launches of zinc-based sunscreens. This ratio is quite high and shows the effect of the recent scrutiny by the FDA on the safety of sunscreens in the US. In general, the US market is in-line with the European market in terms of customer preference of organic-based versus inorganic-based sunscreen formulations. Historically, inorganic sunscreens were more popular in Asia than the rest of the world due to their impact on skin tone.

Figure I. A comparison of the percent of global launches of zinc-based formulations from 2018 to 2020 (to date)

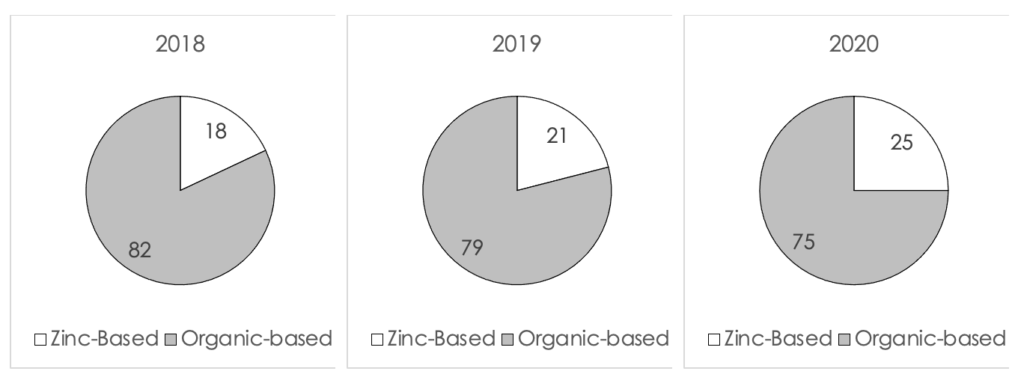

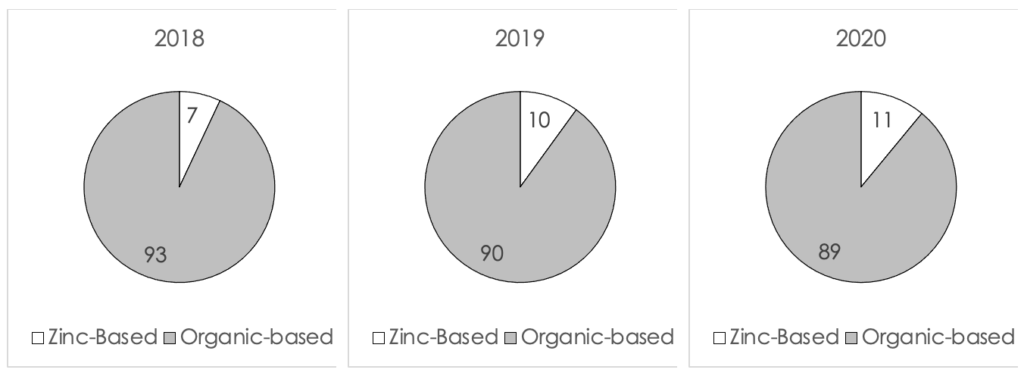

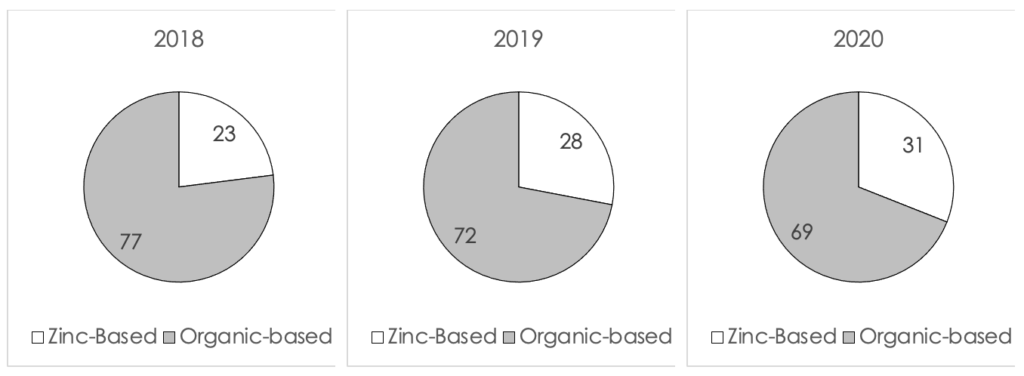

The progressions of the percent of new launches from 2018 to 2020 (to date) in the US, Europe and Asia Pacific are displayed in Figure II, III and IV (below). In the US, the number of zinc-based formulations launched in 2020 increased by 7% from 2018. This is a very significant increase considering that many launches in 2020 were postponed due to COVID-19. In Europe the increase was more modest and kept only at 4%, whereas in Asia Pacific the increase was 8%. It can be seen from the data that the global market was affected by the new direction seen in the US market.

Figure II. A comparison of the percent of launches of zinc-based formulations in North America from 2018 to 2020 (to date)

Figure III. A comparison of the percent of launches of zinc-based formulations in Europe from 2018 to 2020 (to date)

Figure IV A comparison of the percent of launches of zinc-based formulations in Asia Pacific from 2018 to 2020 (to date)

Possible European Actions

To add more complexity to the situation, the European Chemicals Agency, also known as ECHA, is considering classifying most zinc oxide and titanium dioxide sunscreens as microplastics. Since most zinc oxide and titanium-dioxide particles are in the nano range and are typically coated with silicones or other hydrophobic materials, they fit the description of microplastics. This argument is now being debated at the European Union. Considering inorganic sunscreens as microplastics will warrant reformulation of hundreds of formulations worldwide and will have a huge global impact. The impact will be very similar to the one created by the FDA in the US but this one goes in the opposite direction. It will be interesting to see how companies will adapt to all the new regulations. In one aspect, formulators with sunscreen background will be quite in demand and that is a positive outcome for formulation chemists especially during this global crisis of COVID-19. This change will keep all our regulatory experts in demand as well, as someone must decipher what the FDA and ECHA are planning to do in the future. Not to add more complexity, but I am sure China and Australia will come soon with their own guidelines.

Considerations for the Future

For now, the best bet is to be ready and have formulations that will be suitable for the various markets. Global formulations might become a thing from the past.

About the Author

Dr. Hani Fares started his career in personal care studying the effect of solvents on sunscreen chemicals. His interest in skin drug delivery especially from polymeric matrices grew during his graduate work at Rutgers, where he completed his Ph. D. in Pharmaceutics.

Dr. Fares worked at Block Drug and GlaxoSmithKline where he held positions in research and development in the areas of skincare and oral care. After that, he joined L’Oreal where he held several positions of increasing responsibility leading to AVP of skincare. He is currently the Senior Director of skincare and oral care at Ashland Specialty Ingredients. Dr. Fares is the author of many publications, and patents and made many presentations in national and international meetings in the areas of suncare, skincare, and oral care.